Table of Contents

Customs process on International move

One of the fundamental steps of international moving is the traditional customs clearance. When you move into a new country, your personal goods pass through specific ways and are controlled by customs services as soon as they enter the new country.

Your assets must therefore be fully compliant with the requirements of your new country of residence in order to avoid many problems. Because of country-specific restrictions, your business may not be welcome in your new home, or will require at least some form of restrictions or payment of customs duties.

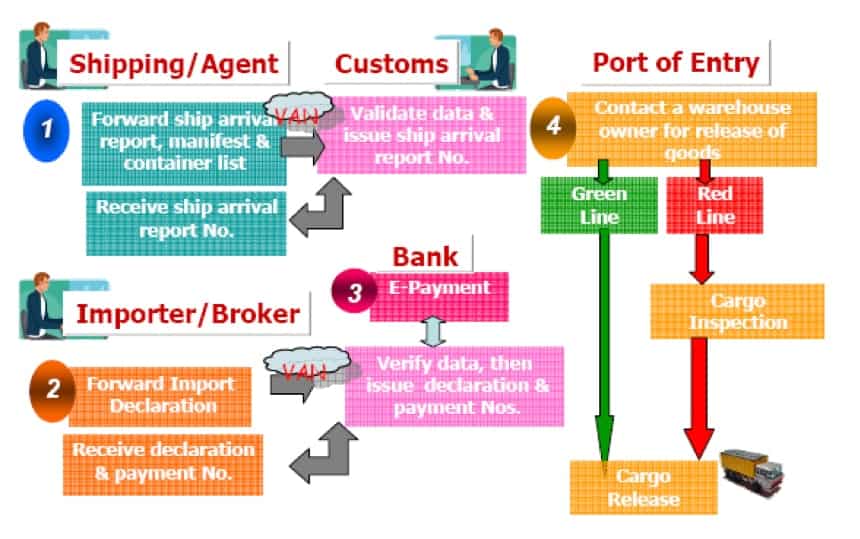

Customs clearance process

Clearance: a difficult step

Customs formalities can sometimes be complicated. They imply a good knowledge of the laws of the country visited and of the specific restrictions that apply in its territory. This is why professional moving companies such as SIAM Relocation often take care of all the administrative aspects of your expatriation and simply ask you to provide them with the necessary documents to prepare your file.

Drugs and medicine are also subject to different severe restrictions from one state to another and the importation of certain substances is prohibited in some countries. Due to different national laws, the importation of some animal and plant species may also be difficult. Your pets must carry a specific passport that will be given to you by your veterinarian.

It is very important to know the exact nature of your property and to ensure that it is not counterfeit. Possession of counterfeit or non-compliant products exposes you to severe fines and possible confiscation of the offending products.

Some countries are particularly repressive about drugs. Detaining any drug in Malaysia will make you subject to the death penalty.

SIAM Tips: Foodstuffs such as fish and meat are subject to very specific restrictions. In all cases, you will have to declare spontaneously your goods subject to this kind of restrictions to the customs services, otherwise you incur heavy penalties in case of control.

Your dedicated SIAM Expert will verify with you the packing list in order to avoid any kind of issue during the customs clearance process.

You are not sure of your packing list? A borderline item? Contact us!

Tax exemption

You should know that Thailand systematically taxes import of personal effects. However, we may apply for a tax exemption possible for following cases:

Thai citizen back to Thailand.

In order to clear the personal belongings of a returning Thai citizen, the required document is the original passport, with the stamps or entry and exit visa of the origin country of the personal belongings.

Moreover, the Thai citizen, must have lived in the country of departure of the move a whole year to benefit from the exemption of taxes and customs duty. Too frequent trips to Thailand during this year may disqualify the case for Thai Customs. Your personal effects must arrive in Thailand no later than 6 months after the arrival of the Thai citizen.

Info SIAM: Thai Customs will check your travel abroad for the two years prior to your arrival in Thailand.

SIAM Example: If the Thai citizen arrives on 21/03/2020, Customs will check his passport from 21/03/2018 to 21/03/2020 (checking entry and exit stamps, countries visited, length of stay ..) How many times has it come to Thailand, the length of stay in Thailand, how many days has it stayed in the country of origin?

*For each stay in Thailand, not more than 3 months. If you have changed your passport recently, keep it as it may be requested.

Foreigner with work permit

A foreigner with a work permit valid for at least one year, with a non-immigrant visa or a residence visa may be exempt from taxes:

Here are the requirements:

- Non-immigrant Visa or Visa resident.

- Work Permit valid for one year

The work permit is a document issued by the Ministry of Labor. It is complementary to Visa, and allows to work legally in Thailand.

Warning SIAM: For foreigners visa visa family “O”, retired “O-A”, student visa “ED”, tourist visa, they are not eligible for taxes exemption.

Thai work permit

What you need to know

- We need the original passport to clear (and work permit if foreigner). You will not be asked to be physically present, SIAM Relocation clears for you.

- The average delay for personal clearance is 4 days.

- Notify all your items in the inventory (packing list) because in case of customs visit, if the customs note omissions, this can create troubles and penalty.

- Customs does not grant any facility or payment period.

- All personal effects of less than 6 months will be taxed.

- The move must happen between 1 month before and 6 months after your arrival.

- A 7% VAT is applied to all invoices in Thailand.

- Electronics or household appliances: only 1 piece per category, 2 if the move is family-related. Example: 1 TV, 1 fridge, 1 microwave ….

Info SIAM: You want further information about local customs ? Visit the official website directly : Thai customs

Automatically taxed items

Even if the tax exemption is obtained, the following items will be taxed:

- Luxury items

- Carpets Marble objects

- bicycles, sporting goods

- musical instrument

- crystal objects

- gold and silver

- porcelain vases ..

Prohibited Items

- Alcohol (you have the right to 3 bottles, but we do not advise you to take alcohol because the license takes a long time to get)

- food (requires import license)

- plants (requires an import license)

- animals (requires an entry permit)

- religious figures

- weapons and ammunition

- drug addicts

- books, videos, pornographic

SIAM Advice: Feel free to contact our sales department if you have any questions about regulation. Our customs broker are experts in this critical step.

SIAM Relocation - Best price moving company in Thailand !

Due to our attractive pricing, many customers trust our services and we thanks them. Stop to overpay the services and save money with our tailored package matching will all type of removals, from small volume to full house, let us find the best and cost-effective option.

Communication is important, which is why we strive to discuss in the most suitable way for you!